Submitting Your First Order

Quick Start Tutorial

Comprehensive Tutorial

Order Entry

Note: These explanations are mainly relevant for the dashboard UI, for API usage, refer to API documentation for precise details on constraints and expected format of inputs.

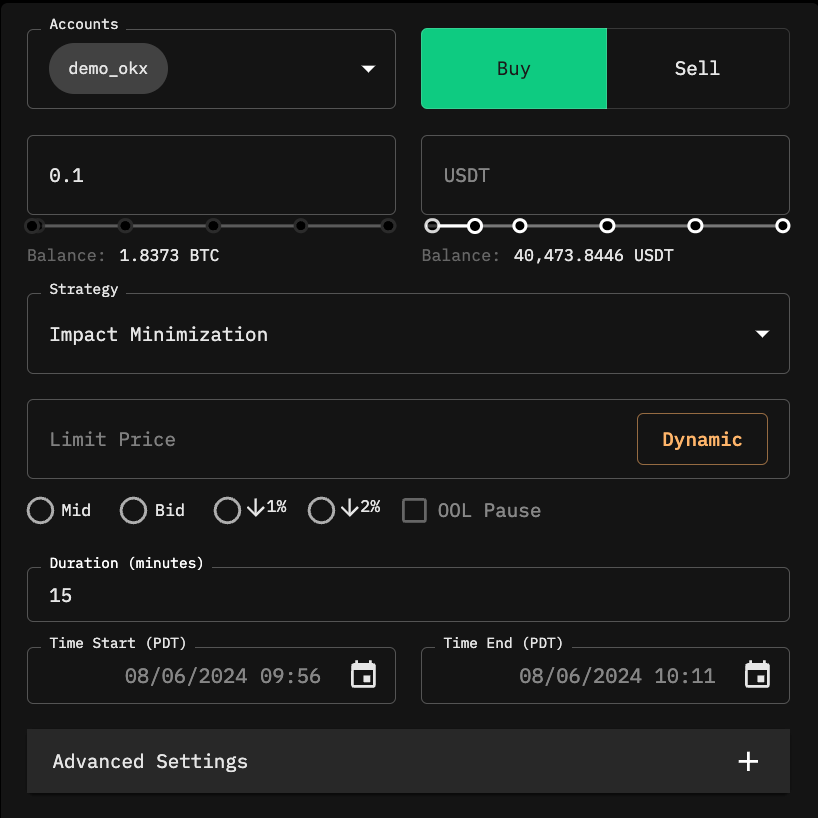

Account

Select one or more accounts to execute the trade.

Base Asset Quantity

Allows you to speicfy the number of tokens (Base Asset) you would like to trade (e.g. I want to trade 5 BTC, for BTC-USDT).

Quote Asset Quantity

Allows you to input the dollar amount (quote asset) you would like to trade. (e.g. I want to trade $2000 worth of BTC-USDT)

A preset execution configuration that combines a selected trajectory with advanced settings to optimize order execution. Refer to the Strategies section for further details.

Limit Price (Optional)

Sets a price cap for the order. The order will not execute at a price worse than the specified limit. After you set a limit price, you will notice that the OOL Pause check mark is ticked. When this is ticked, it means that if market prices are outside the limit price you set, the algorithm pauses execution; the order duration does not get counted get counted. Example: I run an algo order to buy 1 BTC over duration of 60 minutes at a set limit price of $100,000. The algo will only operate when the price is $100,000 or lower. If it is higher, the algo pauses.

Duration

Defines the total execution time for the order in minutes. For multi-day orders, the order is automatically split up into multi-day algo orders each lasting a day.

Time Start (Optional)

Specifies when the order should begin execution.

Time End (Optional)

Specifies when the order should stop execution. If both Time Start and Time End are set, the system calculates the duration automatically.

Advanced Settings

Determines the execution schedule, defining how orders are distributed over time to achieve optimal execution outcomes.

Defines the target share of market volume the engine aims to execute at, dynamically adjusting execution to match this rate.

Sets the maximum percentage of market volume the order can interact with at any given time, preventing excessive exposure.

Controls the placement depth of limit orders. Higher passiveness results in deeper order book placement, prioritizing price efficiency over execution speed.

Allows for controlled variation in execution, enabling more passive fills at the expense of increased tracking variance relative to the benchmark price.

Adjusts the execution curve by front-loading or back-loading the order distribution.

Defines the maximum percentage of the order that can be executed through over-the-counter (OTC) Request for Quotes (RFQs), reducing on-exchange footprint.

Ensures the order is executed exclusively using passive limit orders, market orders will not be used throughout execution.

Enables dynamic limit order placement, adjusting prices in real time based on market conditions.

Restricts the order to only reducing existing positions, preventing accidental position increases. Not available on OKX.

Enables margin trading for spot orders. (Only applicable for Bybit.)

Last updated

Was this helpful?